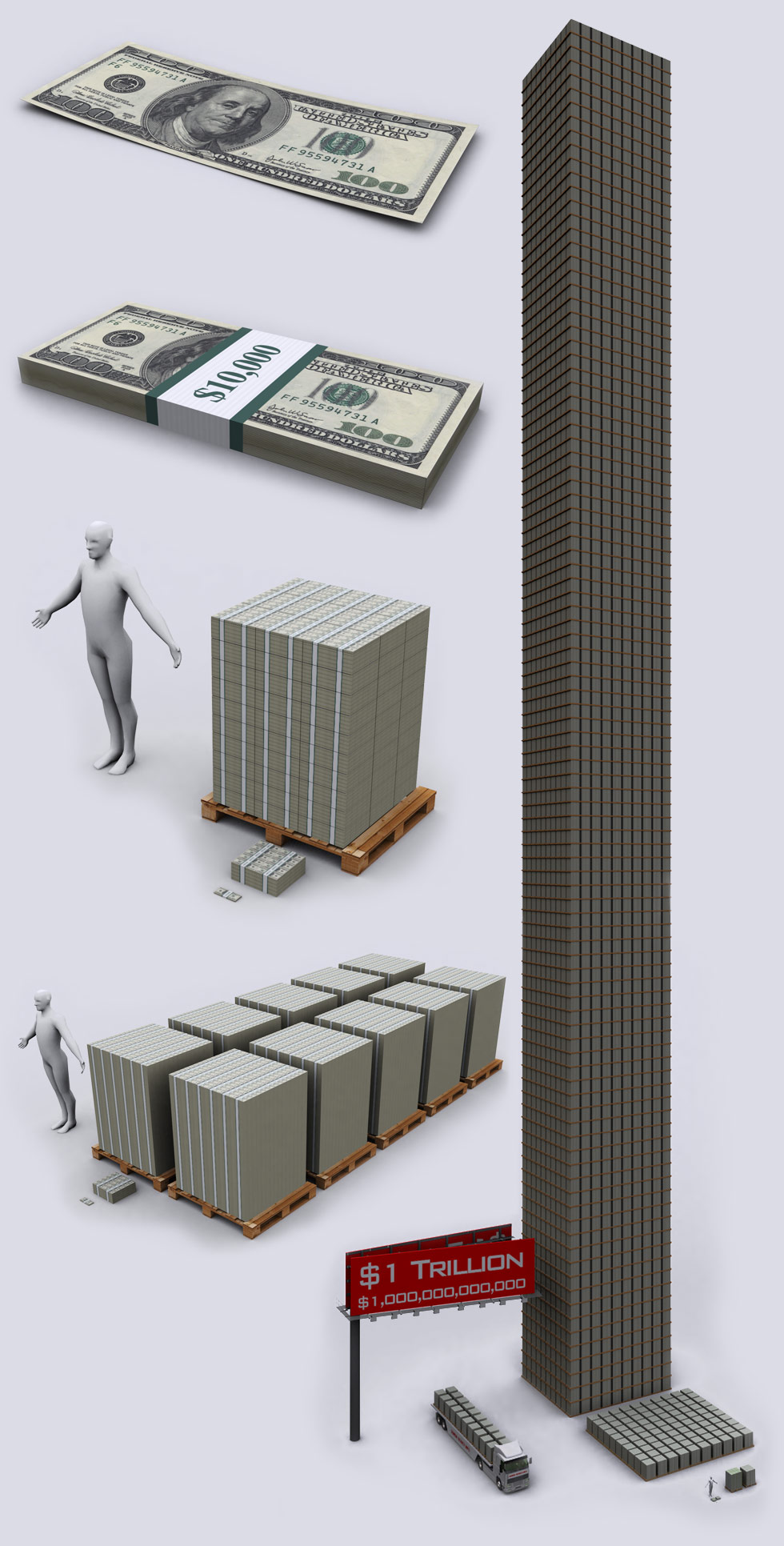

| One Hundred Dollars |

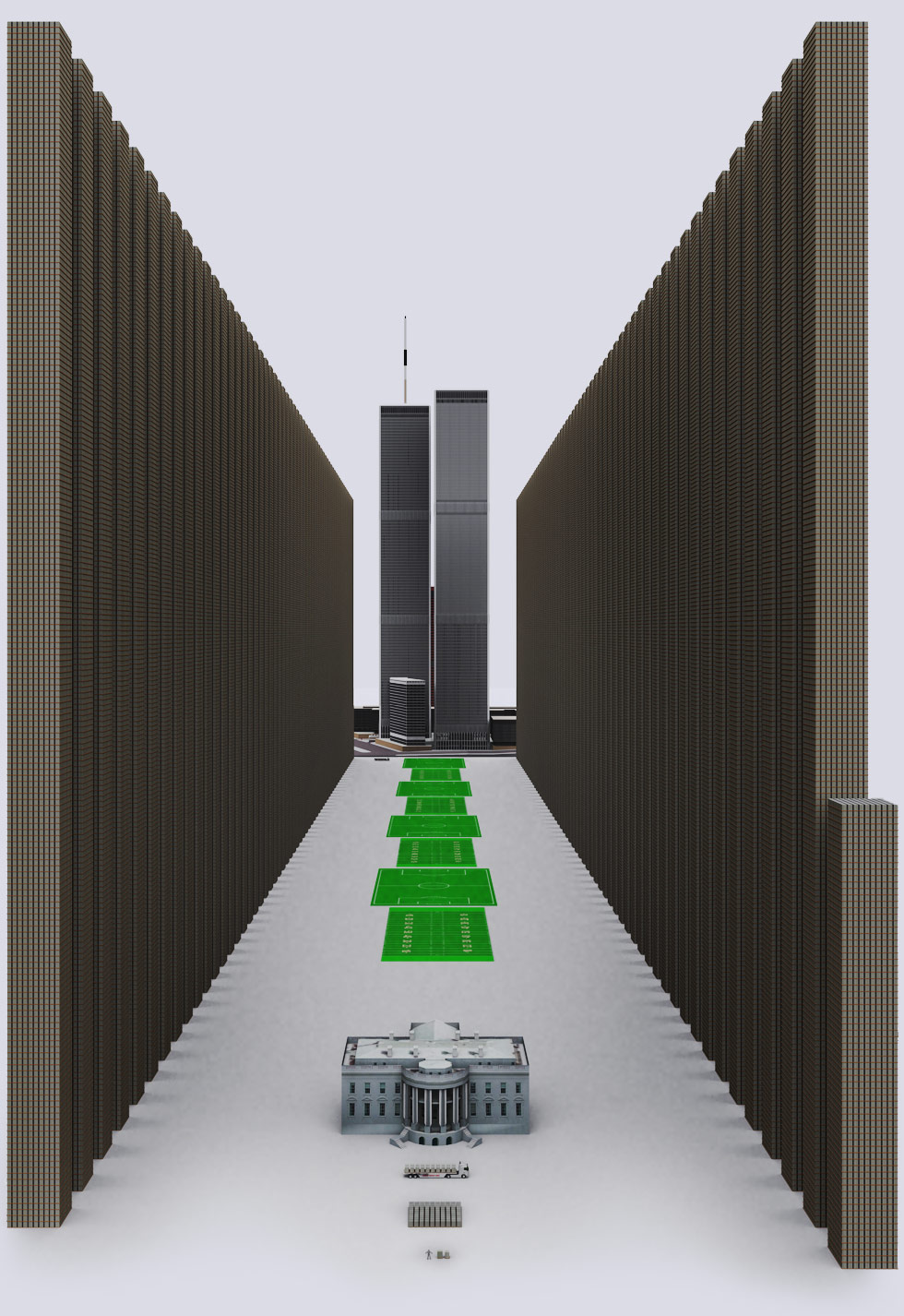

| $100 - Most counterfeited money denomination in the world. Keeps the world moving. |

| Ten Thousand Dollars |

| $10,000 - Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

| 100 Million Dollars |

$100,000,000 - Plenty to go around for |

| 1 Billion Dollars |

$1,000,000,000 - This is how a billion dollars looks like. |

| 1 Trillion Dollars |

$1,000,000,000,000 - When they throw around the word "Trillion" like it is nothing, this is the reality of $1 trillion dollars. The square of pallets to the right is $10 billion dollars. 100x that and you have the tower of $1 trillion that is 465 feet tall (142 meters). |

|

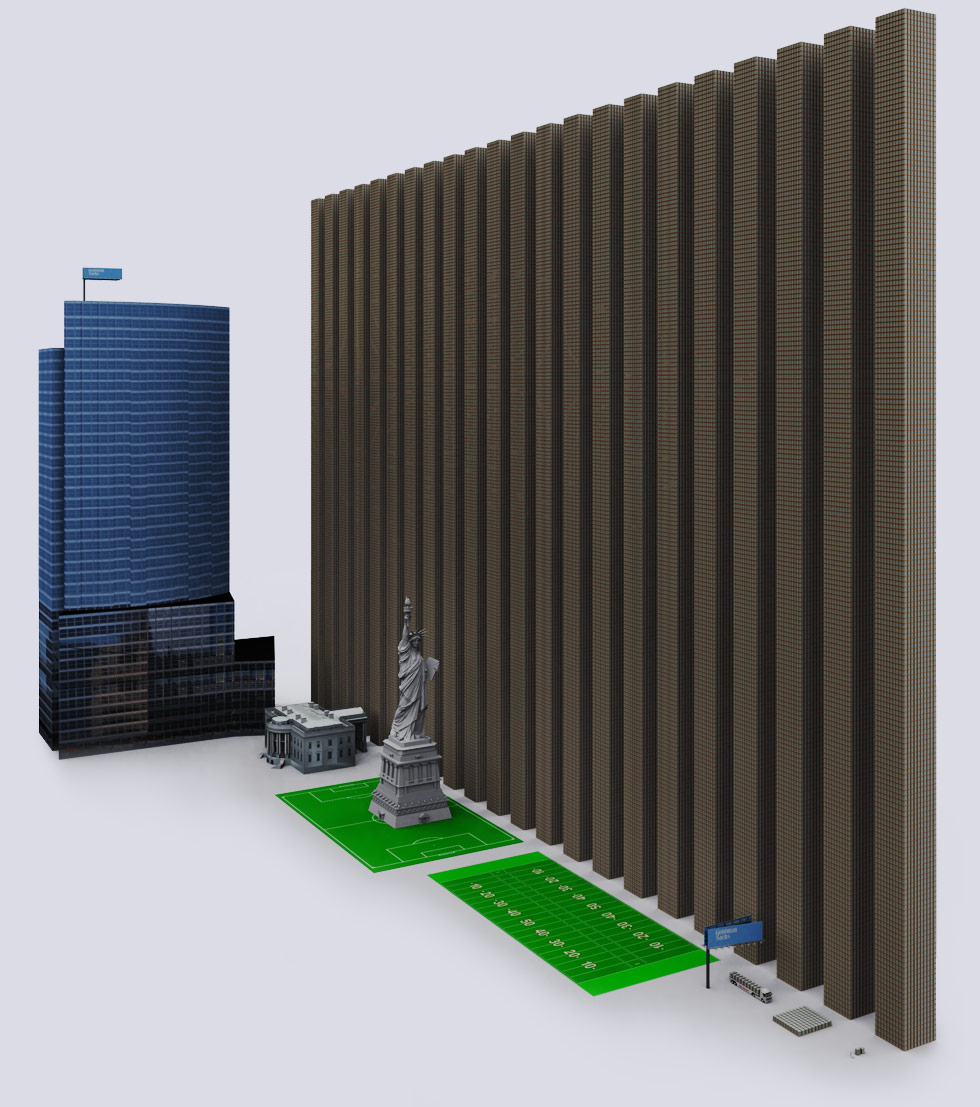

| Bank of New York Mellon |

BNY has a derivative exposure of $1.375 Trillion dollars. |

| State Street Financial |

State Street has a derivative exposure of $1.390 Trillion dollars. |

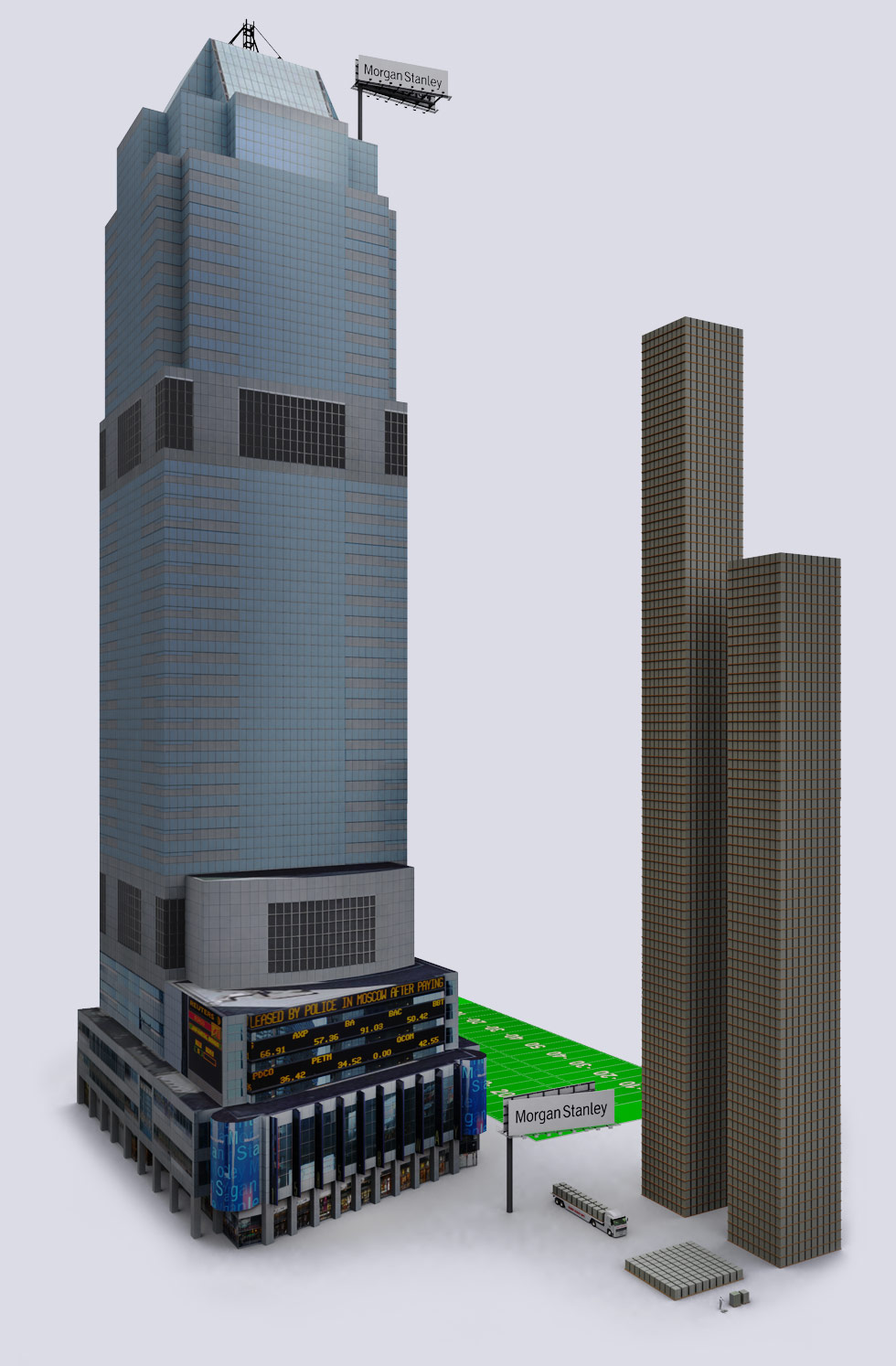

| Morgan Stanley |

Morgan Stanley has a derivative exposure of $1.722 Trilion dollars. |

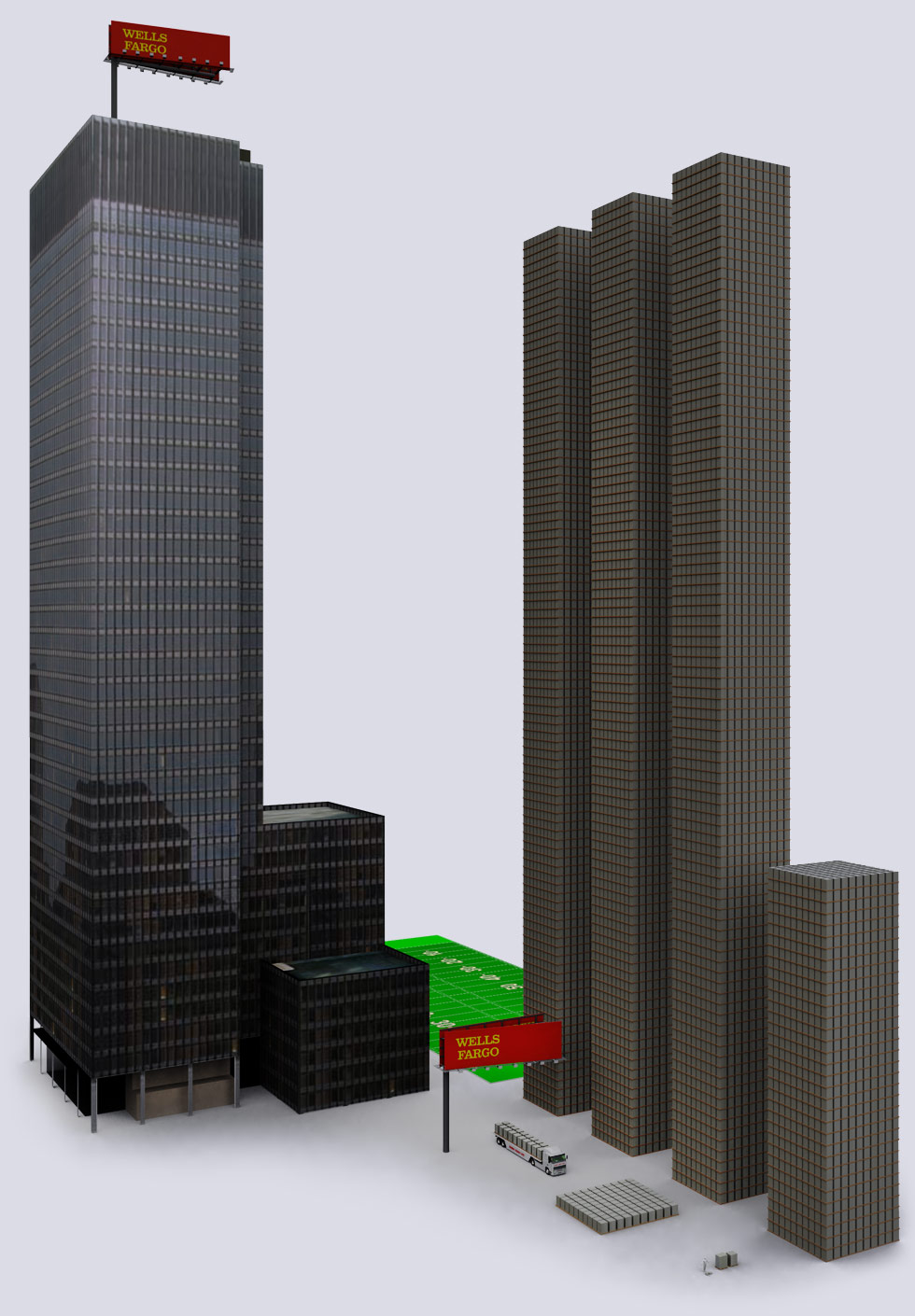

| Wells Fargo |

Wells Fargo has a derivative exposure of $3.332 Trillion dollars. $49 billion in profit during the same time. |

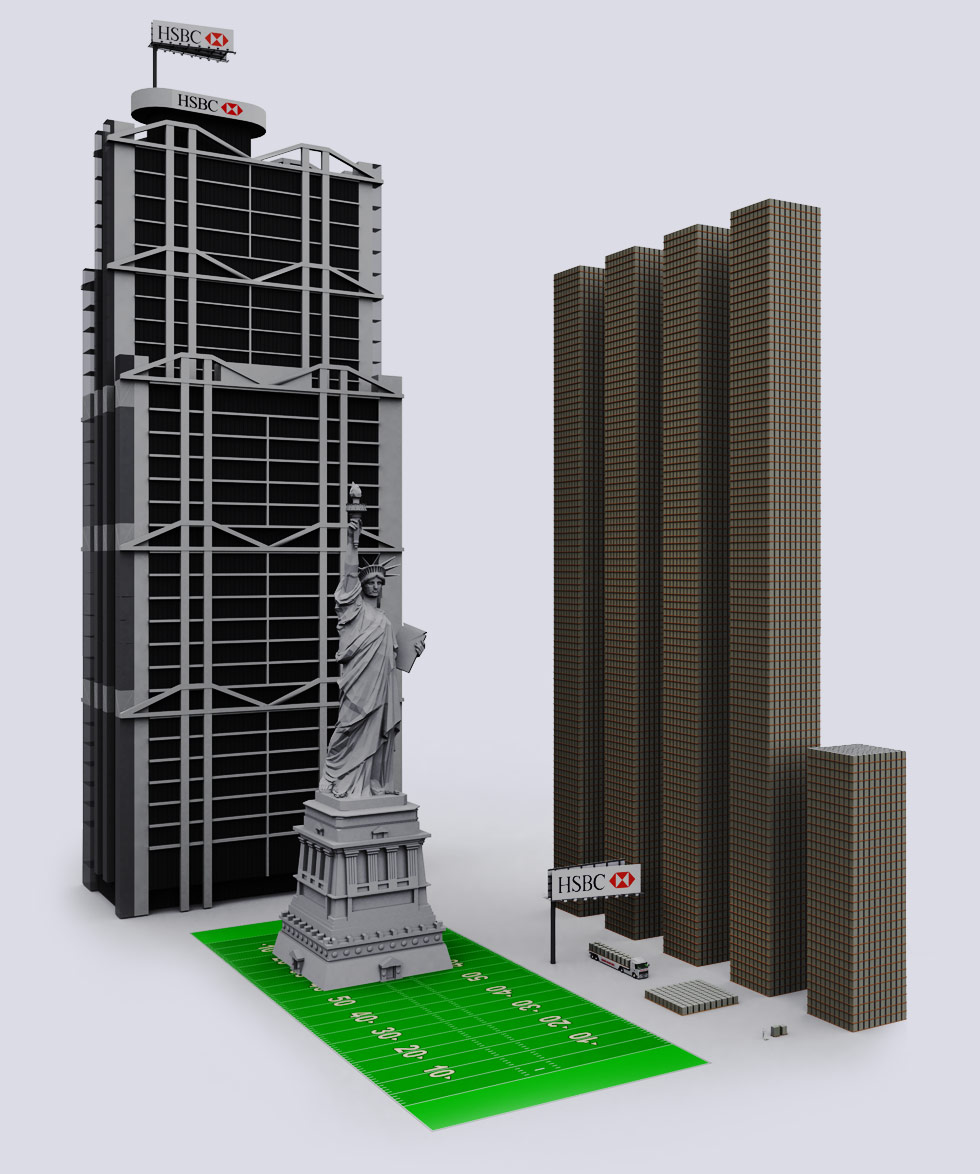

| HSBC |

HSBC has a derivative exposure of $4.321 Trilion dollars. Both HSBC and JP Morgan Chase have strong interest in gold & precious metals. HSBC and JP Morgan Chase are often involved together in financial scandals. Lately HSBC has been sued for allegedly funneling more than $8.9 billion to the largest ponzi-scheme in history - Bernie Maddof's investment business. DZ Bank in Germany is suing HSBC (and JP Morgan) for deceptive (lying) practices when selling home-loan-backed securities. HSBC is also under investigation for laundering billions of dollars. |

| Goldman Sachs |

Goldman Sachs has a derivative exposure of $44.192 Trillion dollars. connections in US Government. A lot of former Goldman employees hold high-level US Government positions (chart). Mitt Romney's top donor is Goldman Sachs, and one of Obama's best donors. Ex-CEO of Goldman Sachs, Hank Paulson became the Secretary of Treasury under Bush and during the 2008 financial crisis authored the TARP bill demanding $700 billion bail-out. In UK, Goldman Sachs escaped £10 million bill on a failed tax avoidance scheme with help of good connections. The bank is the largest player in the food commodities market, earned $955m from food speculation in 2009" - That's your $$$. Goldman Sachs employees are arming themselves with guns in case there is a populist uprising against the bank. Goldman Sachs calls their investors "muppets". and use clients to make money for themselves, disregarding the clients. The bank was fined $22 million for sharing valuable nonpublic information with top clients (Think insider trading with best clients). Goldman Sachs was part-owner America's leading website for prostitution ads until the ownership stake was exposed. Goldman Sachs helped Greece conceal its debt with secret loans, while simultaneously taking advantage of Greece. Goldman Sachs got a $814 billion SECRET bailout from the Federal Reserve during the 2008 crisis. Goldman Sachs got $10 billion of the 2008 TARP bailout, and in the same year paid $10.9 billion in employee compensation and "benefits", while paying a tax rate of 1%. That means an average of $327,000 to each Goldman Sach's employee. |

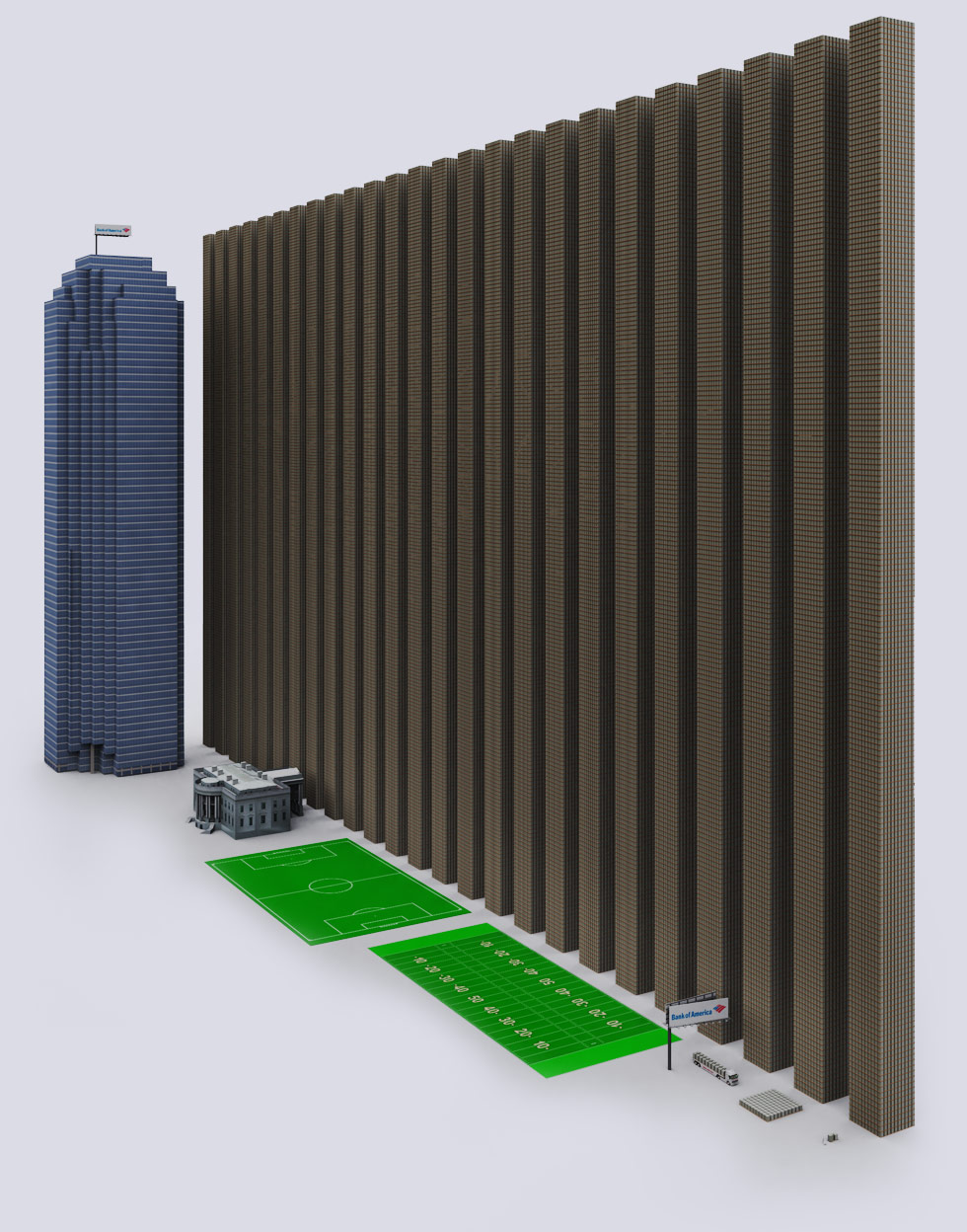

| Bank of America |

Bank of America has a derivative exposure of $50.135 Trillion dollars. BofA is sticking the tax-payers with a MASSIVE bill, by moving derivatives toaccounts insured by the federal government @ total of $53.7 trillion as of 06/2011. During 2011-12 BofA has been in need of cash, so Warren Buffett gave BofA $5 billion. Same year BofA sold its stake in China Construction Bank to raise $1.8 billion in cash. Bank of America paid $22 million to settle charges of improperly foreclosing on active-duty troops BofA recruited 3 cyber attack firms to attack WikiLeaks. but the Anonymous hacker group hacked the security firms first. BofA was sued for $31 billion in home-loan losses in 2011, the bank is involved in many lawsuits, too many to document. BofA also received a SECRET $1.344 trillion dollar bailout from the Federal Reserve. |

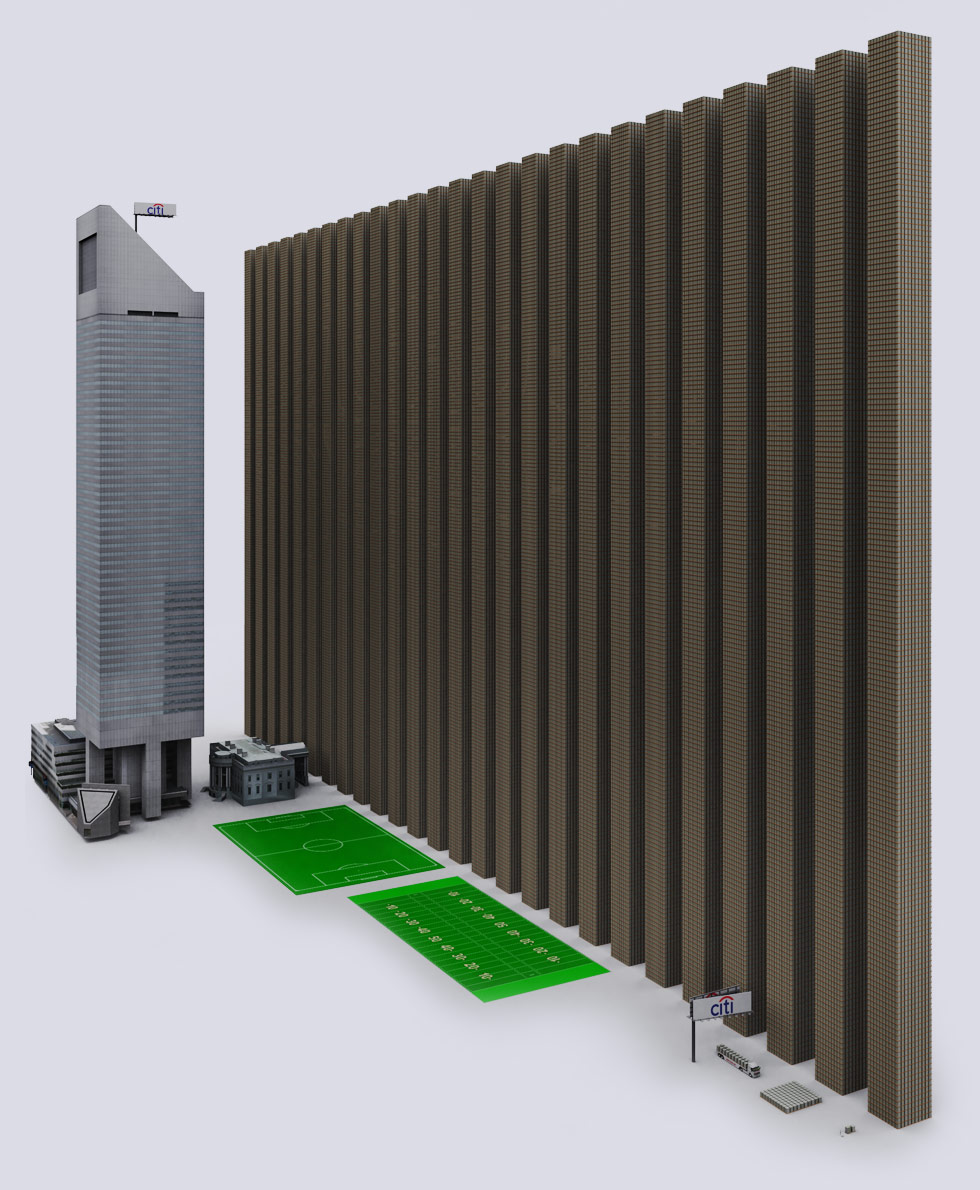

| Citibank |

Citibank has a derivative exposure of $52.102 Trillion dollars. Citibank knowingly passed over bad loans to the Federal Housing Administration to insure. Citigroup also received a SECRET $2.513 trillion dollar bailout from the Federal Reserve. |

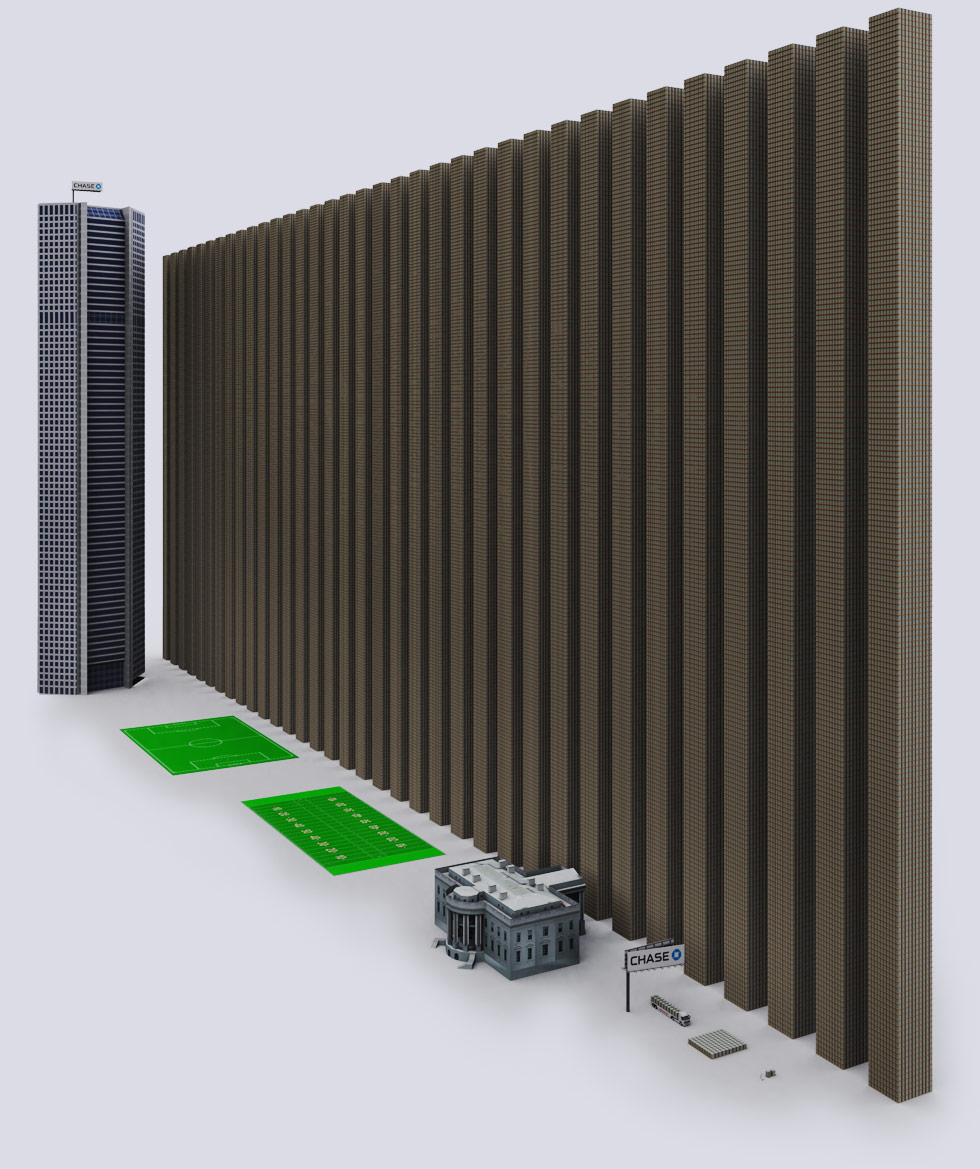

| JP Morgan Chase |

JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars. JP Morgan is rumored to hold 50->80% of the copper market, and manipulated the market by massive purchases. JP Morgan is also guilty of manipulating the silver market to make billions. In 2010 JP Morgan had 3 perfect trading quarters and only lost money on 8 days. Lawsuits on home foreclosures have been filed against JP Morgan. Aluminum price is manipulated by JP Morgan through large physical ownership of material and creating bottlenecks during transport. JP Morgan was among the banks involved in the seizure of $620 million in assets for alleged fraud linked to derivatives. JP Morgan got $25 billion taxpayer in bailout money. It has no intention of using the money to lend to customers, but instead will use it to drive out competition. The bank is also the largest owner of BP - the oil spill company. During the oil spill the bank said that the oil spill is good for the economy. |

| 9 Biggest Banks' Derivative Exposure - $228.72 Trillion |

Note the little man standing in front of white house. The little worm next to lastfootball field is a truck with $2 billion dollars. Derivative Data Source: ZeroHedge |

| More Infographics |

No comments:

Post a Comment